About ABS

Strategic transitions. Exceptional outcomes.

ABS is a seasoned M&A advisory firm helping founders and privately held companies navigate sell-side exits, buy-side growth, valuation clarity, and coaching for exit or growth. We bring big-firm quality to the lower middle market with the confidentiality, precision, and senior attention owners deserve.

Why we exist

You built something meaningful. Our job is to help you realize the full value of that work—whether you’re preparing to sell, raise capital, or acquire. We align valuation, timing, and deal dynamics to produce outcomes that stand up long after closing.

About ABS

Strategic transitions. Exceptional outcomes.

Why we exist

You built something meaningful. Our job is to help you realize the full value of that work—whether you’re preparing to sell, raise capital, or acquire. We align valuation, timing, and deal dynamics to produce outcomes that stand up long after closing.

ABS is a seasoned M&A advisory firm helping founders and privately held companies navigate sell-side exits, buy-side growth, valuation clarity, and coaching for exit or growth. We bring big-firm quality to the lower middle market with the confidentiality, precision, and senior attention owners deserve.

What we do

Sell-Side Advisory

Position, negotiate, and close with strategic and private equity buyers who value what you’ve built.

Buy-Side Representation

Define the thesis, source proprietary opportunities, and execute disciplined acquisitions.

Business Valuation

Market-grounded valuations that inform decisions—not just a number.

Coaching for Exit or Growth

Founder/Owner-first advisory to sharpen strategy, raise enterprise value, and set the next move.

What we do

Sell-Side Advisory

Position, negotiate, and close with strategic and private equity buyers who value what you’ve built.

Buy-Side Representation

Define the thesis, source proprietary opportunities, and execute disciplined acquisitions.

Business Valuation

Market-grounded valuations that inform decisions—not just a number.

Coaching for Exit or Growth

Founder/Owner-first advisory to sharpen strategy, raise enterprise value, and set the next move.

The ABS story

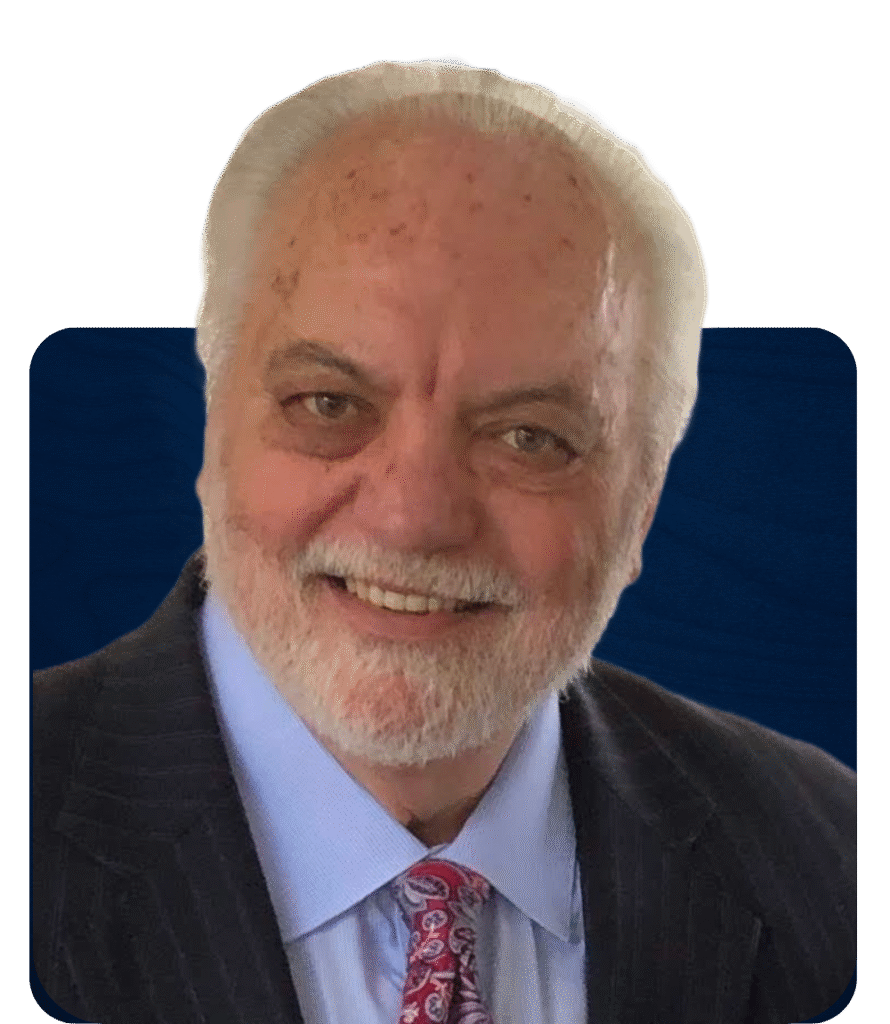

ABS was founded by Tim Vincent Purselley, a transformational CEO and dealmaker with 40+ years in entrepreneurship, operations, and corporate development. Since 1996, Tim has led ABS as Managing Director—representing buyers and sellers in middle-market transactions totaling over $700MM in enterprise value—and coaching owners to scale, professionalize operations, and prepare for successful, well-timed exits.

Beyond ABS, Tim serves on various boards and charities, is a voracious reader, avid golfer, and passionate cook, and—together with his wife Patti—enjoys time with family and grandkids.

Mission

To be a premier business advisory firm that solves difficult, meaningful problems—and is to be known for transparency, strong relationships, precise execution, and exceptional performance on behalf of our clients

Vision

“To deliver exceptional outcomes for our clients through operational excellence, decades of experience, and the highest integrity.”

What we stand for

- Integrity — Decisions grounded in professional standards and ethics.

- Connection — Relationships are essential to great outcomes.

- Innovation — Thoughtful, creative, and practical ideas.

- Teamwork — We accomplish more together.

- Dependability — Clarity, candor, and follow-through.

- Growth — Constantly developing our capabilities.

- Accountability — Ownership of actions and outcomes.

Why founders choose ABS

Lower-middle-market focus with big-firm rigor.

Confidential, founder/Owner-Focused process that protects relationships and enterprise value.

Deal engineering that goes beyond headline price to optimize structure, tax, and certainty.

Curated buyer networks (PEGs and strategics) and targeted outreach—never spray-and-pray.

Hands-on senior leadership from strategy through close.

Outcomes beyond a sale—including growth capital, recapitalizations, and succession.

The ABS story

ABS was founded by Tim Vincent Purselley, a transformational CEO and dealmaker with 40+ years in entrepreneurship, operations, and corporate development. Since 1996, Tim has led ABS as Managing Director—representing buyers and sellers in middle-market transactions totaling over $700MM in enterprise value—and coaching owners to scale, professionalize operations, and prepare for successful, well-timed exits.

Beyond ABS, Tim serves on various boards and charities, is a voracious reader, avid golfer, and passionate cook, and—together with his wife Patti—enjoys time with family and grandkids.

Mission

To be a premier business advisory firm that solves difficult, meaningful problems—and is to be known for transparency, strong relationships, precise execution, and exceptional performance on behalf of our clients

Vision

“To deliver exceptional outcomes for our clients through operational excellence, decades of experience, and the highest integrity.”

What we stand for

- Integrity — Decisions grounded in professional standards and ethics.

- Connection — Relationships are essential to great outcomes.

- Innovation — Thoughtful, creative, and practical ideas.

- Teamwork — We accomplish more together.

- Dependability — Clarity, candor, and follow-through.

- Growth — Constantly developing our capabilities.

- Accountability — Ownership of actions and outcomes.

Why founders choose ABS

Lower-middle-market focus with big-firm rigor.

Confidential, founder/Owner-Focused process that protects relationships and enterprise value.

Deal engineering that goes beyond headline price to optimize structure, tax, and certainty.

Curated buyer networks (PEGs and strategics) and targeted outreach—never spray-and-pray.

Hands-on senior leadership from strategy through close.

Outcomes beyond a sale—including growth capital, recapitalizations, and succession.

Who We Serve

Customized Advisory for Entrepreneurs, Founders, and Private Equity Buyers

Sell-side exits, recaps, and Coaching for Exit or Growth.

You’re not just selling a company—you’re transitioning your life’s work.

CURATED DEAL FLOW AND DISCIPLINED BUY-SIDE EXECUTION.

Curated opportunities. Discreet access. Insight that accelerates deals.

LEGACY-FIRST TRANSITIONS—CONFIDENTIAL AND ALIGNED.

A transition plan that respects your values, people, and future.

Who We Serve

Customized Advisory for Entrepreneurs, Founders, and Private Equity Buyers

Founded by a veteran dealmaker with entrepreneurial roots and international negotiation experience…

Founders & Owners

You’re not just selling a company—you’re transitioning your life’s work.

Sell-side exits, recaps, and Coaching for Exit or Growth.

Curated deal flow and disciplined buy-side execution.

Private Equity & Strategic Buyers

Curated opportunities. Discreet access. Insight that accelerates deals.

Family-Owned & Privately Held Businesses

A transition plan that respects your values, people, and future.

Legacy-first transitions—confidential and aligned.

Trusted. Strategic. Proven.

Founders & Owners

EBITDA Range: $1MM–$20MM Whether you’re preparing for retirement, exploring your next chapter, or fielding unsolicited interest, we help owners navigate the complexity of a high-stakes exit. Our team provides valuation clarity, strategic deal structure, and a confidential process designed to protect your legacy and unlock the full value of what you’ve built. We understand founder psychology—and we help you move from overwhelmed to in control.

Private Equity & Strategic Buyers

ABS offers tailored deal flow for PEGs and corporate acquirers seeking lower middle-market investments with meaningful upside. We bring forward sellers who are prepared, coachable, and vetted—often off-market. With decades of experience on both sides of the table, we’re more than a transaction conduit—we’re a strategic partner who understands speed, alignment, and integration imperatives.

Family-Owned & Privately Held Businesses

Family businesses carry unique dynamics—shared history, generational planning, and often, difficult decisions. We guide owners through partial exits, employee buyouts, recapitalization, and full sale scenarios that preserve culture and continuity. From navigating sibling shareholders to managing second-generation leadership questions, we bring discretion, sensitivity, and structure to every conversation.

Considering next steps for your business?

Why Choose ABS

Big-firm M&A rigor, founder/Owner-Focused

We help lower-middle-market owners realize the value of their life’s work—through disciplined sell-side exits, targeted buy-side growth, market-grounded valuation, and coaching for exit or growth. Confidential. Precise. Outcome-driven.

What do you get if you use our service

- Affordable Pricing & Fast Service

- 725MM+ transaction closed

- Consultant Experts In Their Field

- Transaction Tax Planning

- Wealth legacy Strategies

- Growth/Exit Planning

- Seminars and Workshops

- International Tax Planning

Why Choose ABS

Big-firm M&A rigor, founder/Owner-Focused

We help lower-middle-market owners realize the value of their life’s work—through disciplined sell-side exits, targeted buy-side growth, market-grounded valuation, and coaching for exit or growth. Confidential. Precise. Outcome-driven.

What do you get if you use our service

- Affordable Pricing & Fast Service

- 725MM+ transaction closed

- Consultant Experts In Their Field

- Transaction Tax Planning

- Wealth legacy Strategies

- Growth/Exit Planning

- Seminars and Workshops

- International Tax Planning

How we work

6 Steps to Working with ABS

A discreet, senior-led process that protects value while moving you from clarity to close.

01.

Confidential discovery

Define goals, timing, and constraints under NDA; align on fit and path.

02.

Readiness & valuation

Normalize financials, assess readiness, and deliver a market-grounded valuation.

03.

Positioning & materials

Craft the narrative, build the CIM, prep the data room, and ready leadership.

04.

Curated outreach

Target PEGs and strategics; controlled release of materials; manage dialogues.

05.

Negotiation & structure

Drive LOIs and terms; optimize price, structure, tax, and certainty of close.

06.

Diligence & close

Orchestrate diligence, coordinate advisors, close cleanly, and hand off a transition plan.

How we work

6 Steps to Working with ABS

A discreet, senior-led process that protects value while moving you from clarity to close.

01.

Confidential discovery

Define goals, timing, and constraints under NDA; align on fit and path.

02.

Readiness & valuation

Normalize financials, assess readiness, and deliver a market-grounded valuation.

03.

Positioning & materials

Craft the narrative, build the CIM, prep the data room, and ready leadership.

04.

Curated outreach

Target PEGs and strategics; controlled release of materials; manage dialogues.

05.

Negotiation & structure

Drive LOIs and terms; optimize price, structure, tax, and certainty of close.

06.

Diligence & close

Orchestrate diligence, coordinate advisors, close cleanly, and hand off a transition plan.

Begin Your Transition with Confidence.

Whether you’re preparing to sell, purchase or considering acquiring growth capital, or simply exploring your options, our first conversation is 100% confidential and pressure-free.

Begin Your Transition with Confidence.

Whether you’re preparing to sell, purchase or considering acquiring growth capital, or simply exploring your options, our first conversation is 100% confidential and pressure-free.

“ABS coached us from a handful of stores into a private equity Transaction that eventually went public at a exponential valuation. Their strategy didn’t just close the deal, it maximized our future”.

— Former Wingstop Founder

Deals That Redefine Possibility

In an exit from a single success story — and that’s just one of many. Explore real stories of how ABS has helped founders, owners, and investors achieve exceptional outcomes.

Deals That Redefine Possibility

In an exit from a single success story — and that’s just one of many. Explore real stories of how ABS has helped founders, owners, and investors achieve exceptional outcomes.

“ABS coached us from a handful of stores into a private equity Transaction that eventually went public at a exponential valuation. Their strategy didn’t just close the deal, it maximized our future”.